What is Loan EMI?

Loan EMI Calculator (Equated Monthly Installment) is the principal, rate and interest you have to pay monthly to the bank as a consideration for their loan. It includes both your principal amount and interest on it. So, it is always wise that you manage your payment enough systematically so that you can keep a good CIBIL Score and also don’t have to pay late payment or other charges.

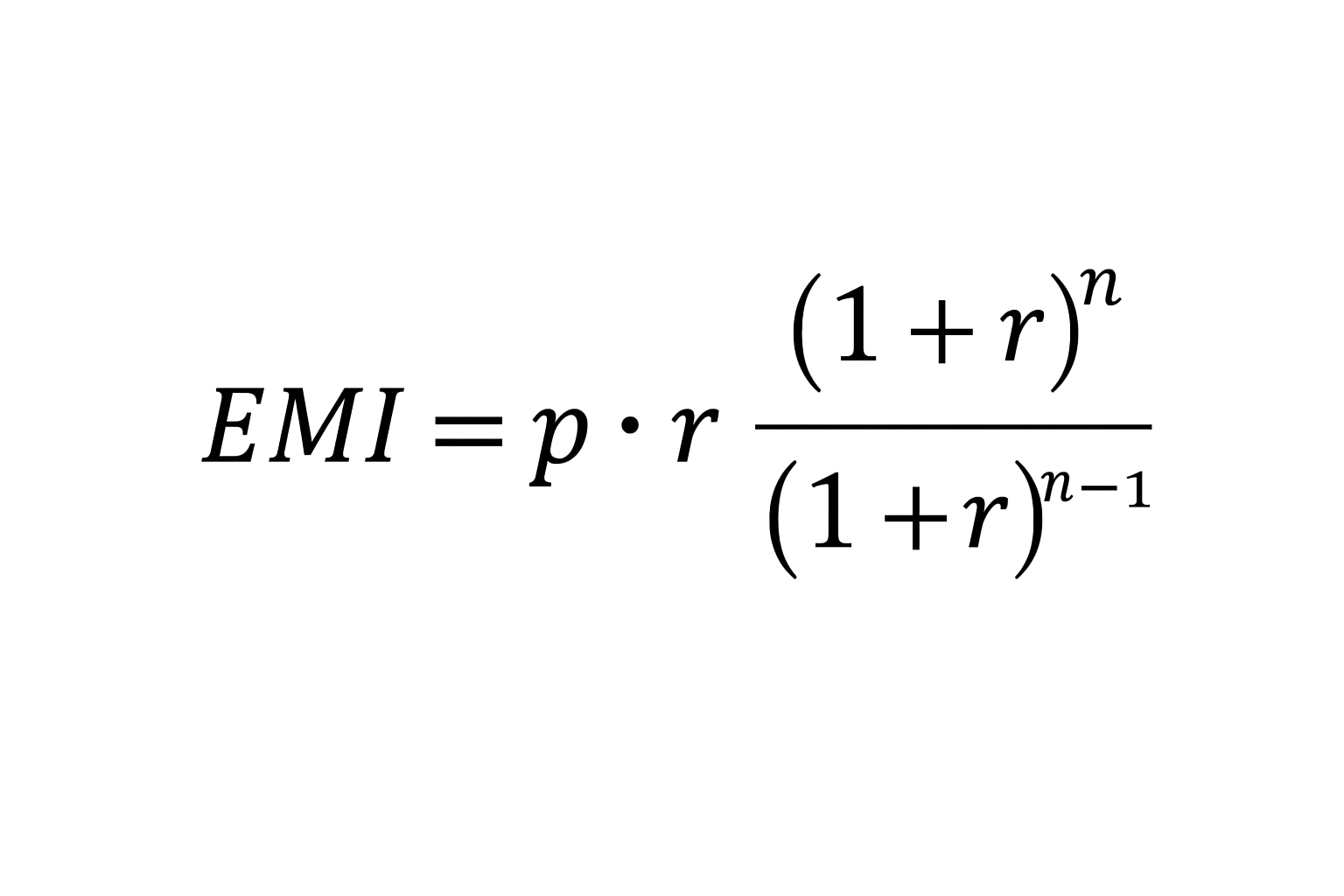

How is Loan EMI Calculated?

Loan EMI is calculated using the following formula:

Where,

For instance, in case you have borrowed ₹10,00,000 at an annual interest of 10.5% for a period of 10 years then as per EMI calculator per month your EMI will be ₹13,493.

Loan EMI calculation can be difficult to do but with Ruloans loan EMI calculator you can calculate your monthly instalments within seconds.

Factors that can impact your due amount

Several factors can influence your EMI amount:

- Loan Amount : Higher the loan amount, higher the EMI.

- Interest Rate : The interest rate will directly impact your EMI. If the interest rate is high, you will have to pay a higher amount as your monthly outgoing.

- Please note though that with longer tenures, the loan interest paid by you would be more.

- Prepayment: If you have some funds then you can prepay your loan. Prepayments help in reducing your principal amount which will in-turn reduce your EMI or Loan tenure whichever is feasible to you.

How to Use Loan EMI Calculator Online

Using the EMI calculator online is simple:

- Enter Loan Details : Input the total amount you wish to borrow.

- Select the Interest Rate : Choose the applicable interest rate for your loan.

- Loan Tenure: Decide on the tenure you wish to repay the loan.

- Click ‘Calculate’: You’ll instantly get your EMI amount, along with the complete breakdown of principal and interest payable.

Why Use an EMI Calculator?

Take charge of your financial future with confidence! The intuitive EMI Calculator from Dityam Consultancy Pvt. Ltd. lets you compare multiple loan options, plan your repayments smartly, and choose a loan amount that matches your financial capacity—ensuring a smooth repayment experience without future stress. Dityam Consultancy Pvt. Ltd., one of India’s leading loan distribution companies, offers a diverse portfolio of loan products including Personal Loans, Business Loans, Loans Against Property, Education Loans DSA, and more. With over ₹30+ crores in loans disbursed and a PAN-India presence across 40+ cities, we bring you the best loan options, competitive deals, and expert guidance—all in one place. Use our expertly designed EMI Calculator to make informed decisions and start your loan journey with clarity and confidence—powered by the experience and trust of Dityam Consultancy Pvt. Ltd.!

![]() Home

Home

![]() Personal

Personal

![]() Business

Business

Monthly EMI: ₹ 0

Principal Amount: ₹ 0

Interest Payable: ₹0